CREDIT UNION

OUR INTEGRATED CRM SOLUTION FOR CREDIT UNION

OUR CLIENTS

Previous

Next

FIND OUT HOW WE CAN HELP

Solution Metrix offers robust credit union CRM solutions and integration services designed specifically for your Credit Union’s unique requirements. We automate your critical business processes and enhance your member experience. How? By configuring your credit union’s CRM to include all your required workflows, integrations, and seamless connections between marketing, sales, member management, and customer service. We’re your go-to partner for hassle-free CRM implementation, integration, and maximized utilization.

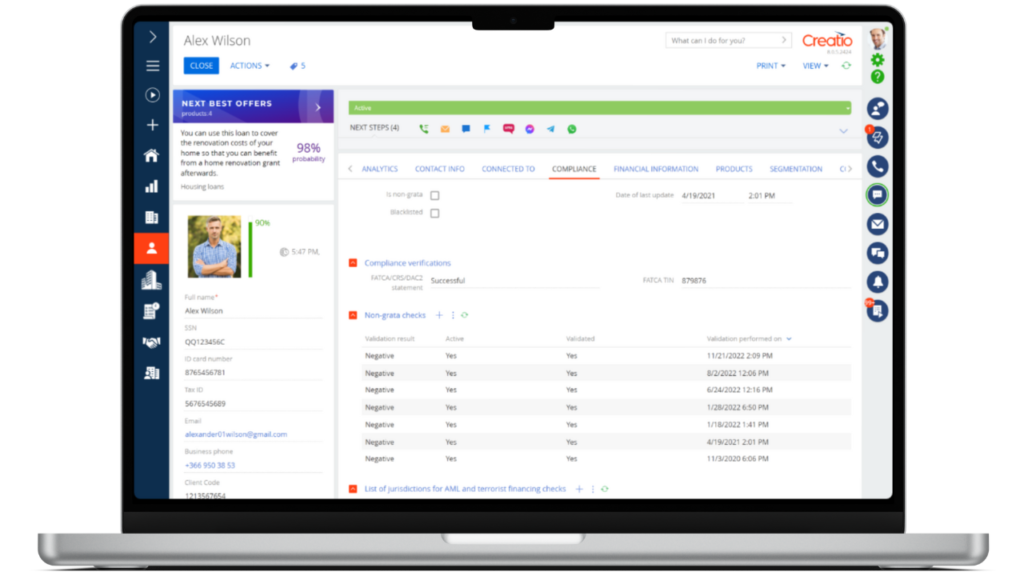

MEMBER 360°

Offer a member experience they can’t find anywhere else.

Access a complete view of your member profiles to keep track of their journeys, from the onboarding process to a complete follow-up of their referrals. Centralize their information to have complete visibility of products and future opportunities.

Take advantage of integration with your credit union’s core banking system to have a complete and updated member profile with the latest product acquisitions and interactions. (Symitar from Jack Henry & Fiserv DNA is supported).

Keep your members’ profiles automatically updated. Accelerate the signing and renewal of loan applications thanks to seamless integrations that reduce processing and response times. (Meridian Link is supported)

Calculate the value of a household by keeping all relationships visible . Benefit from an artificial intelligence component to non-intrusively suggest and upsell the next-best offer based on household preferences.

Complete visibility of Member’s profitability KPI’s, including transactional data from core banking system.

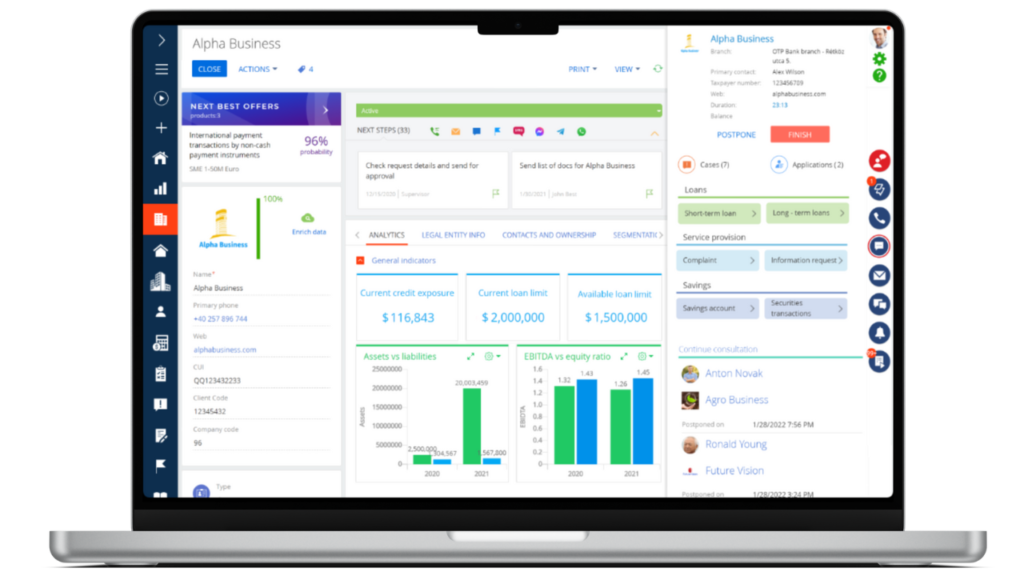

SALES

Optimize your sales cycles for better results.

Track and capture your leads from different sources into a unified database, assigning them to the right consultant. Standardize a qualification process and follow-ups to accomplish the best conversion rates of your commercial relationships.

Manage a unified product catalogue with specific characteristics that help you trigger the next-best offer—just at the right time.

Automate the sales process providing visibility to your consultants during the negotiation and onboarding of a new commercial product.

Automate the account opening processes, including document management and data validation. Optimize approval response times and keep your members always informed about their application status.

Simplify and automate the application processes, including verification workflows and approvals, with any of your credit union’s custom policies.

Increase member engagement by using a machine learning component to offer the next-best product based on members’ interests, location, or history.

Increase your member community and conversion rates with automated processes to manage indirect members and referral programs. Analyze real-time KPIs to ensure steady, profitable growth.

Leverage the Creatio mobile app to provide sales the tools they need to accelerate the sales cycle.

Improve and measure the real-time performance of agents and branches by analyzing the defined objectives and key performance indicators.

SERVICE

Become renowned for your fast and effective customer service.

Offer a personalized customer service by capturing all cases and automatically classifying them into specific categories with optimized Service Level Agreements (SLAs). Maintain constant communication with your members and gain invaluable feedback.

Assign the right agent based on the nature of the inquiry and ticket routing rules.

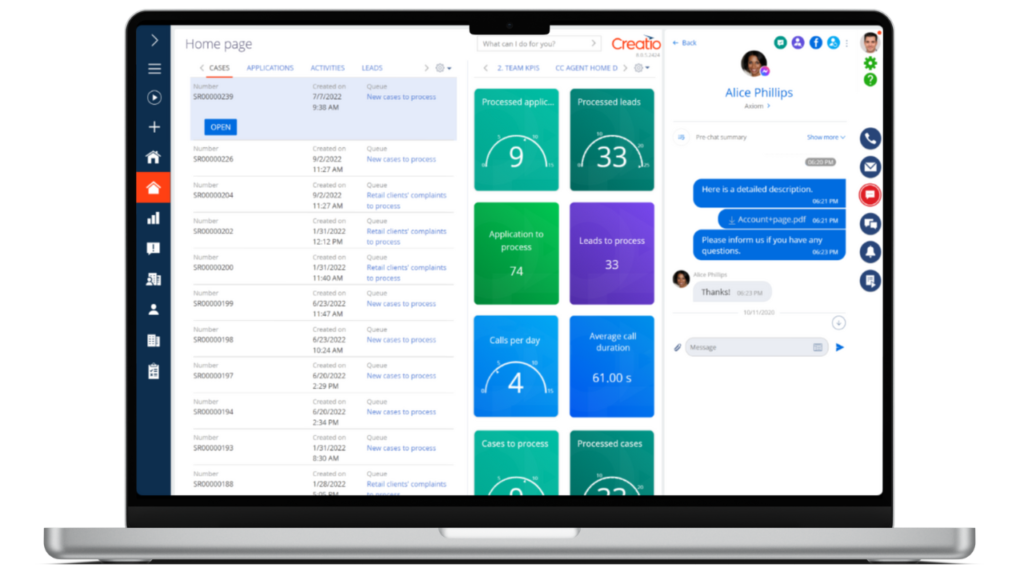

Improve your agent’s experience, productivity and employee experience by providing a user-friendly desktop with clear visibility of assigned tickets prioritized by resolution times.

Offer different service levels to each member and simplify the prioritization of their requests.

Manage ticket resolution times and prioritization by categorizing tickets with different Service Level Agreements (SLAs).

Offer an omnichannel solution that integrates different communication options, including your telephony system.

Improve and measure the real-time performance of agents, customer service response times and satisfaction levels of your members by analyzing the defined objectives and key performance indicators.

MARKETING

Elevate your marketing initiatives for a higher ROI.

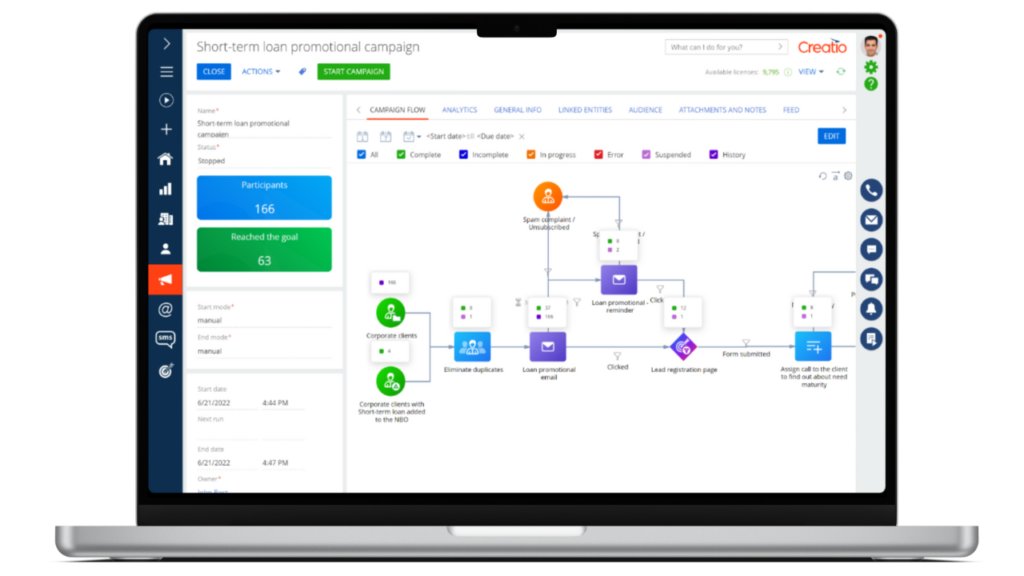

Deliver personalized and impactful marketing campaigns using robust segmentation to improve member retention and constant lead generation.

Analyze your sales trends considering multiple variables like products & services, branches, territories, members, and more.

If you want more information, book now a free consultation with one of our experts.

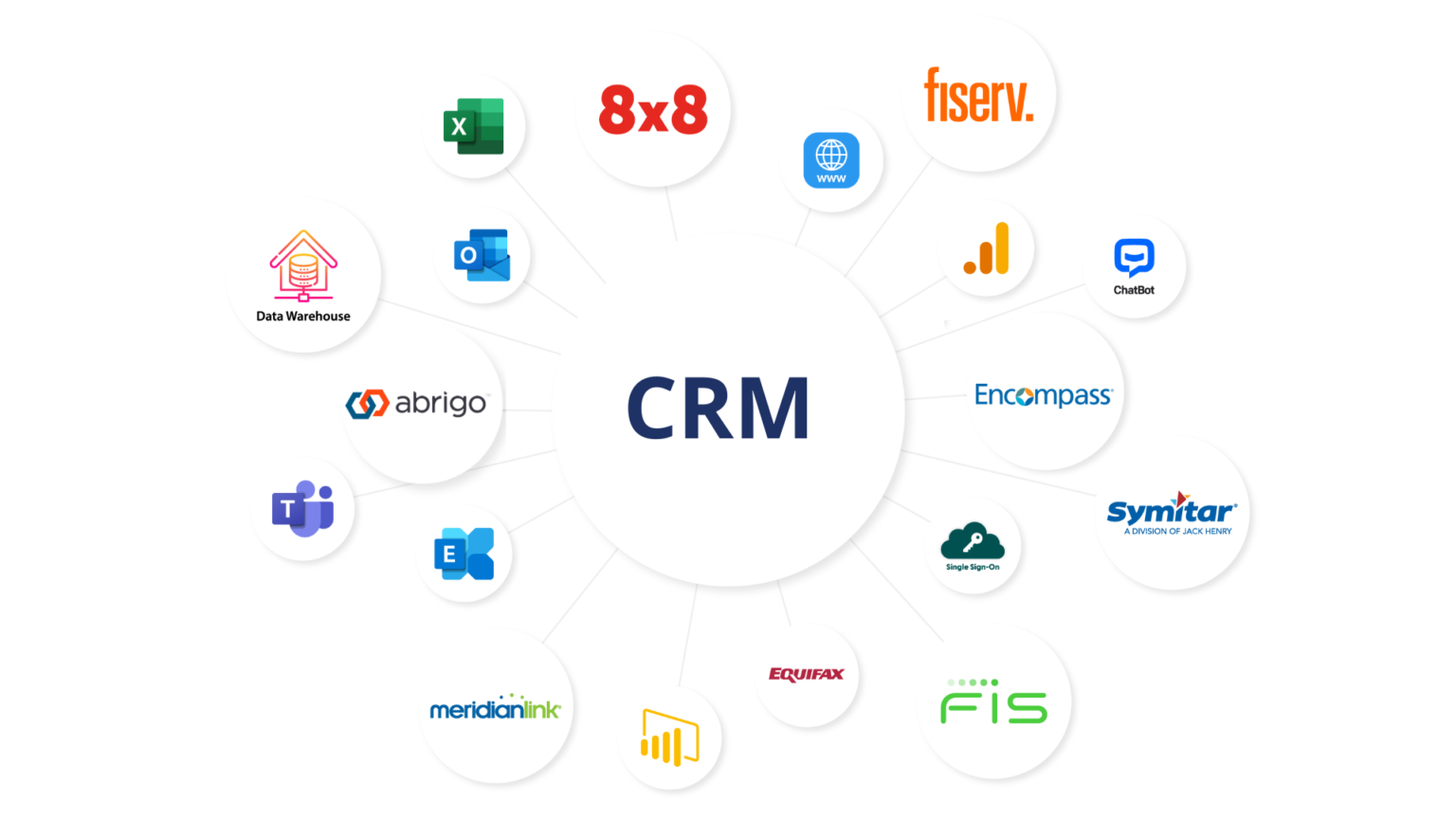

OUR INTEGRATIONS

- TRIAL

Jack Henry Symitar connector for Creatio

Jack Henry Symitar Connector allows you import Accounts, Names, Shares, Loans and Cards to Creatio.

- COMING SOON

Fiserv connector for Creatio

Unlock your financial institution’s full potential with the Fiserv-Creatio integration connector.

- COMING SOON

Meridianlink connector for Creatio

A tool for synchronizing data between the two systems.

Are you a credit union with data all over multiple systems?

Discover how CRM can help.

POTENTIAL INTEGRATIONS WITH CREDIT UNION CRM

And many more…

MEMBER OF...

Previous

Next

Other resources

CRM FOR CREDIT UNIONS

CRM for Credit Unions: Highlights

CRM (Customer Relationship Management) for credit unions is a specialized tool designed to enhance the member experience and streamline internal processes. With their unique focus on member service, credit unions can benefit significantly from CRM features such as a 360-degree view of each member, advanced analytics for understanding member preferences, and automated capabilities in sales and marketing.

CRM software for credit unions integrates seamlessly with core banking systems, document management software, and other critical operational systems. Given the sensitive nature of the data handled by credit unions, CRM systems for these institutions are designed with robust security controls. The adoption of CRM in credit unions signifies a commitment to enhanced member service, improved efficiency, and a modern approach to managing member relationships.

Key Features of Credit Union CRM Systems

- 360-Degree Member View: Credit Union CRM systems offer a comprehensive view of each member’s profile, including transaction history, account details, communication records, and preferences. This feature enables credit unions to better understand their members’ needs and offer personalized services.

- Advanced Analytics: These systems come equipped with analytics tools that can dissect vast amounts of data to reveal insights into member behavior, preferences, and trends. This allows for more targeted marketing campaigns and product offerings.

- Member Segmentation: Credit Union CRMs can segment members based on various criteria like age, income, account types, and activity levels. This segmentation helps in tailoring services and communication to meet the specific needs of different member groups.

- Marketing Automation: Automated marketing tools within the CRM enable credit unions to send targeted, timely, and relevant communications to members. This includes email campaigns, personalized offers, and regular updates about new services or changes.

- Sales Tracking and Management: The CRM tracks and manages sales activities, from lead generation to closing deals. It helps in identifying potential opportunities for cross-selling and upselling services to existing members.

- Customer Service and Support: CRMs provide tools for managing member inquiries and support tickets efficiently. Integration with communication channels like email, phone, and chat ensures that member issues are resolved promptly and satisfactorily.

- Mobile Accessibility: Many credit union CRM solutions offer mobile access, allowing staff to access member information and perform tasks on the go. This enhances flexibility and responsiveness.

- Integration Capabilities: These systems can integrate with existing banking software and third-party applications, ensuring a seamless flow of information across different operational areas of the credit union.

- Compliance and Security Features: Given the sensitive nature of financial data, Credit Union CRMs are designed with robust security protocols and compliance features to protect member information and adhere to regulatory standards.

- Customizable and Scalable: The best credit union CRM is customizable to fit the institution’s specific needs and scalable to accommodate growth and changing requirements.

Credit Union CRM Implementation: Examples of Solving Paint Points

One of the vital paint points credit unions face is how their contact centers served members and obtain a holistic view of them. It was on the way to providing timely and high-quality service. The process of members assisting required navigating through multiple layers resulting in extended customer waiting times. In this case, the ideal decision will be to use a unified system where employees efficiently access crucial data, significantly reducing customer waiting times. The system’s capability to retrieve data makes it possible to provide more individualized and customized services, improving the member experience.

No less problem credit unions face is limitations within their marketing. The institution’s standalone marketing tool and core banking system often have a lack of integration, thus leading to delays and inefficiencies in any communication efforts. Employees have to repeat interactions that consume time and effort to retrieve information. To solve this issue, showcasing tailored offers to the appropriate members can be a magic wand. By using data-driven insights, marketing teams may operate campaigns and segment audiences more effectively. This guarantees that marketing tactics are well-thought-out, precise, and successful. All these steps in CRM implementation for credit unions deliver ongoing success in delivering a member-centric experience.

Success Factors of CRM for Credit Unions

The success of CRM (Customer Relationship Management) implementation in credit unions hinges on several key factors:

- Member-Centric Approach: A successful CRM system for a credit union must prioritize member experience. This involves understanding member needs, preferences, and behavior, and using this understanding to deliver personalized services.

- Integration with Existing Systems: Seamless integration with existing banking and operational systems is crucial. This ensures a unified view of member data, facilitates efficient workflows, and avoids data silos.

- Data Quality and Management: Maintaining high-quality, accurate, and up-to-date member data is essential. Good data management practices help in making informed decisions and offering relevant services to members.

- User Adoption and Training: The effectiveness of a CRM system largely depends on its adoption by staff. Providing comprehensive training and support encourages user adoption and ensures that the system is used to its full potential.

- Customization and Flexibility: The CRM system should be customizable to align with the unique processes and needs of the credit union. Flexibility to adapt to changing requirements is also important.

- Effective Change Management: Implementing a CRM system often requires changes in existing processes and workflows. Effective change management strategies are necessary to ensure a smooth transition and buy-in from all stakeholders.

- Robust Security Measures: Given the sensitive nature of financial data, CRM systems for credit unions must incorporate comprehensive security features. This includes role-based access control to restrict data access based on user roles, and detailed user activity logs to monitor and audit system usage.

- Ongoing Support and Maintenance: Regular updates, maintenance, and support from the CRM provider help in resolving issues promptly and keeping the system up-to-date with new features and security standards.

- Performance Monitoring and Analytics: Regularly monitoring the performance of the CRM system through analytics helps in understanding its impact on business operations and member services, allowing for continuous improvement.

- Strategic Alignment: The CRM implementation should align with the overall strategic goals of the credit union, such as improving member retention, increasing sales, or enhancing service quality.

Focusing on these factors can significantly contribute to the successful implementation and utilization of a CRM system in a credit union, ultimately leading to improved member satisfaction and operational efficiency.

LOOKING FOR A TAILORED CRM IMPLEMENTATION?

Solutions Metrix offers platform-agnostic CRM solutions to top banks, credit unions, and many other institutions in the US and Canada.