- CREDIT UNION

OUR INTEGRATED

CRM SOLUTION FOR

CREDIT UNIONS

Learn more

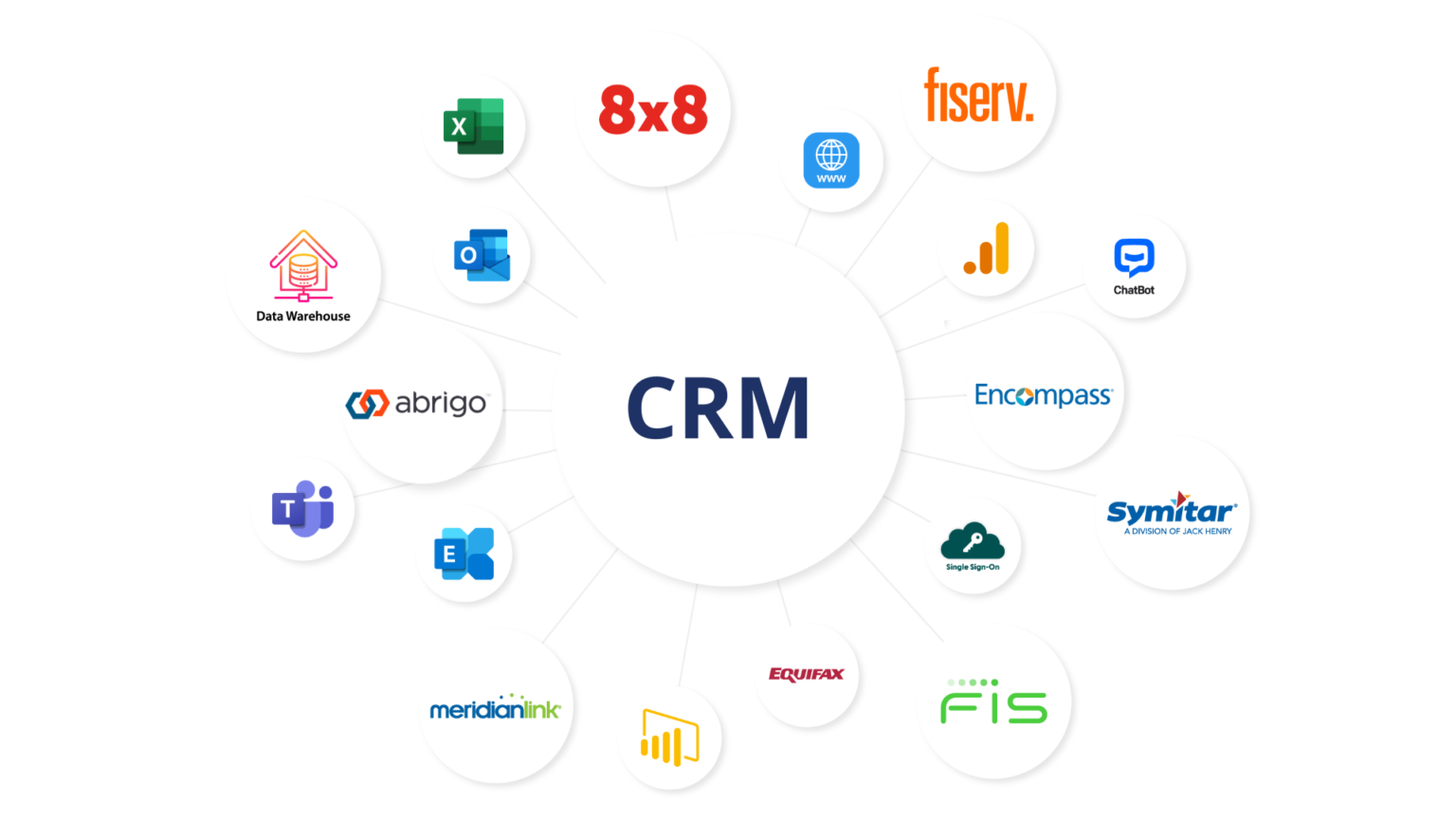

Solution Metrix offers robust credit union CRM solutions and integration services designed specifically for your Credit Union’s unique requirements. We automate your critical business processes and enhance your member experience. How? By configuring your credit union’s CRM to include all your required workflows, integrations, and seamless connections between marketing, sales, member management, and customer service. We’re your go-to partner for hassle-free CRM implementation, integration, and maximized utilization.

Offer a member experience they can’t find anywhere else.

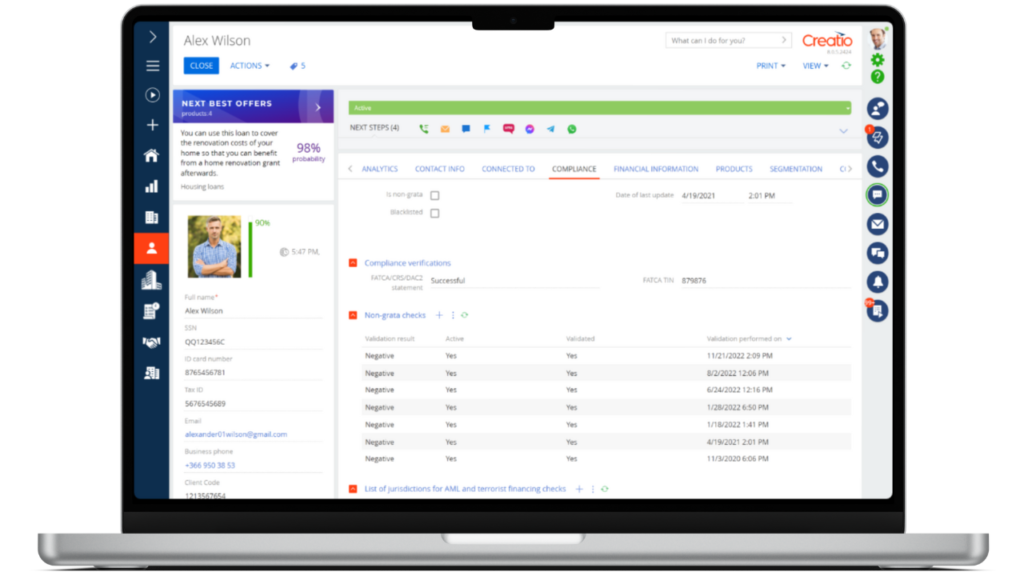

Access a complete view of your member profiles to keep track of their journeys, from the onboarding process to a complete follow-up of their referrals. Centralize their information to have complete visibility of products and future opportunities.

Take advantage of integration with your credit union’s core banking system to have a complete and updated member profile with the latest product acquisitions and interactions. (Symitar from Jack Henry & Fiserv DNA is supported).

Keep your members’ profiles automatically updated. Accelerate the signing and renewal of loan applications thanks to seamless integrations that reduce processing and response times. (Meridian Link is supported)

Calculate the value of a household by keeping all relationships visible . Benefit from an artificial intelligence component to non-intrusively suggest and upsell the next-best offer based on household preferences.

Complete visibility of Member’s profitability KPI’s, including transactional data from core banking system.

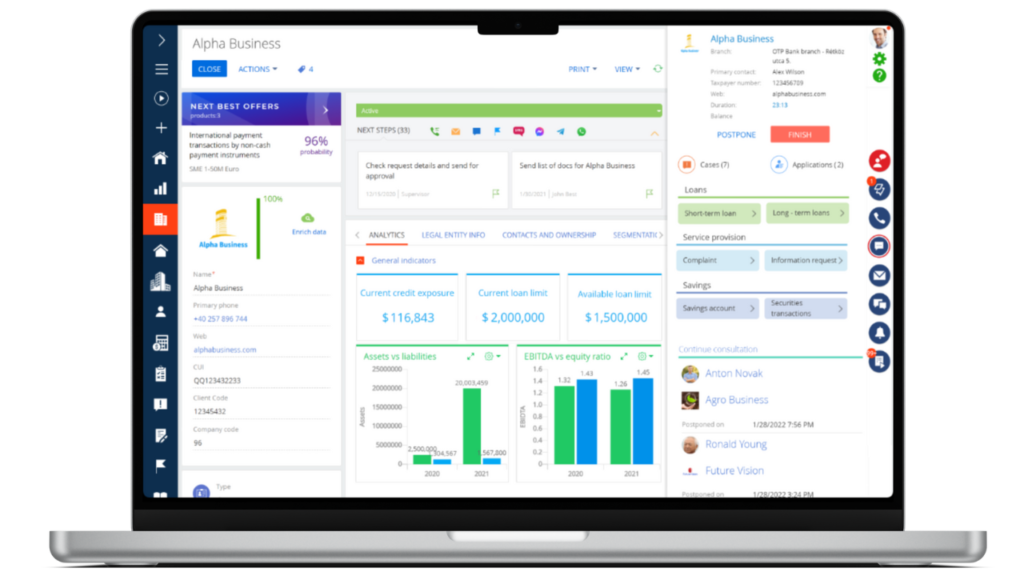

Optimize your sales cycles for better results.

Track and capture your leads from different sources into a unified database, assigning them to the right consultant. Standardize a qualification process and follow-ups to accomplish the best conversion rates of your commercial relationships.

Manage a unified product catalogue with specific characteristics that help you trigger the next-best offer—just at the right time.

Automate the sales process providing visibility to your consultants during the negotiation and onboarding of a new commercial product.

Automate the account opening processes, including document management and data validation. Optimize approval response times and keep your members always informed about their application status.

Simplify and automate the application processes, including verification workflows and approvals, with any of your credit union’s custom policies.

Increase member engagement by using a machine learning component to offer the next-best product based on members’ interests, location, or history.

Increase your member community and conversion rates with automated processes to manage indirect members and referral programs. Analyze real-time KPIs to ensure steady, profitable growth.

Leverage the Creatio mobile app to provide sales the tools they need to accelerate the sales cycle.

Improve and measure the real-time performance of agents and branches by analyzing the defined objectives and key performance indicators.

Become renowned for your fast and effective customer service.

Offer a personalized customer service by capturing all cases and automatically classifying them into specific categories with optimized Service Level Agreements (SLAs). Maintain constant communication with your members and gain invaluable feedback.

Assign the right agent based on the nature of the inquiry and ticket routing rules.

Improve your agent’s experience, productivity and employee experience by providing a user-friendly desktop with clear visibility of assigned tickets prioritized by resolution times.

Offer different service levels to each member and simplify the prioritization of their requests.

Manage ticket resolution times and prioritization by categorizing tickets with different Service Level Agreements (SLAs).

Offer an omnichannel solution that integrates different communication options, including your telephony system.

Improve and measure the real-time performance of agents, customer service response times and satisfaction levels of your members by analyzing the defined objectives and key performance indicators.

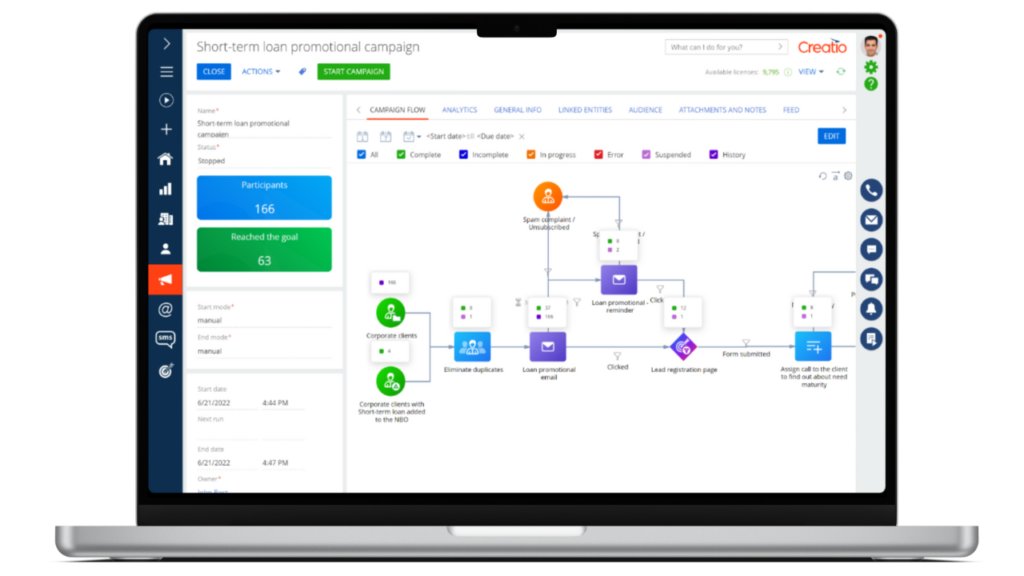

Elevate your marketing initiatives for a higher ROI.

Deliver personalized and impactful marketing campaigns using robust segmentation to improve member retention and constant lead generation.

Analyze your sales trends considering multiple variables like products & services, branches, territories, members, and more.

Jack Henry Symitar Connector allows you import Accounts, Names, Shares, Loans and Cards to Creatio.

Unlock your financial institution’s full potential with the Fiserv-Creatio integration connector.

A tool for synchronizing data between the two systems.

Are you a credit union with data all over multiple systems?

Discover how CRM can help.

And many more…