CRM for Banking Industry —

Consulting & Platforms Implementation

Optimize customer interaction with our CRM consulting & implementation services for banking.

We will help you build an effective customer relationship management system

to increase loyalty, boost sales, and reduce costs.

OUR CLIENTS

Improved Sales Strategies

CRM provides a 360-degree view of client profiles. Banks need to identify valuable clients and partners, see the history of interactions, and leverage the data gathered from different applications. You can use the data to gather insights and reports about your clients and build sales strategies to increase your revenue and improve your position in this highly concurrent industry.

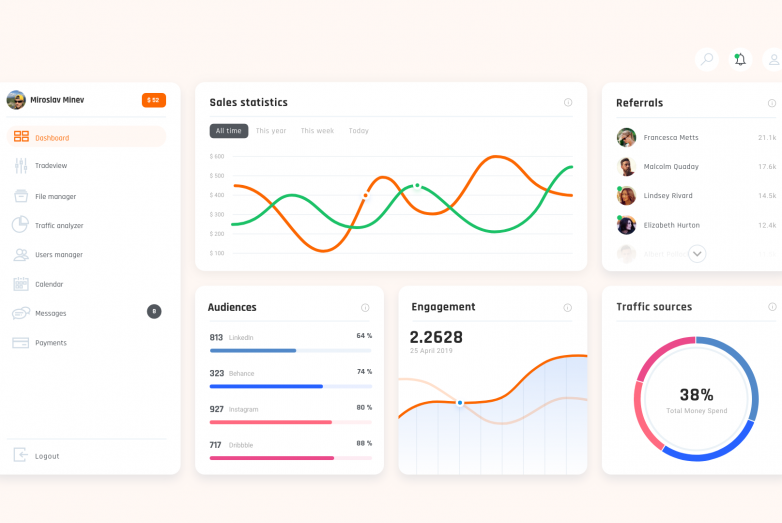

Improved Customer Service

By implementing a good CRM, customer service agents can resolve requests quicker and easier thanks to a unique profile per customer. All the interactions are easily accessible. This increases customer satisfaction rates and improves the organization’s reputation. After all, the future belongs to the customer experience around your product or service through each stage of your sales channels.

Improved Consistent Quality

Implement standard business processes followed by everyone in your organization to reduce the processing time of applications and avoid human errors. You can impose your organization’s standards on anything you desire. It can be a sales process, the underwriting process, or a claim/support process. CRM will allow you to ensure uniformity and make sure that your standards come with consistent quality.

Improved Scalability and Adaptability

CRM platforms are highly customizable and could be integrated with any internal or external application easily. This leads your business to make changes in record-breaking time and reduce time-to-market, especially with all the new players on board. Innovation is the driving force behind the most successful companies. CRM makes sure your innovations reach your clients quickly.

Clients’ Warm Words about Our CRM Consulting Services

“Thanks very much for your great support on this project. It was a pleasure working with you.”

"Thanks Olivier! A big thanks on turning around solutions so quickly in the last couple of weeks for the slight issues we discovered. The team went live with the safety abroad system on Wednesday and I couldn’t be happier!"

Looking to Upgrade Your Current CRM

or

Make the Switch to a Better System?

Banking CRM Frequently Asked Questions

FAQs

What does Customer Relationship Management mean in the banking industry?

CRM in banking meaning refers to Customer Relationship Management systems that help banks build stronger relationships with their customers. These systems are designed to improve customer service, optimize sales processes, and enhance overall customer satisfaction. When answering what is CRM in banking, it’s about understanding and managing customer data to offer personalized services. Management tools centralize interactions, allowing banks to provide tailored solutions and strengthen loyalty. For those wondering what is Digital Solutions in finance, it’s a strategic approach to managing client relationships in financial sectors. Specifically, CRM in banking meaning involves analyzing customer behavior, identifying needs, and delivering relevant financial products. With these systems, banks can streamline workflows, reduce response times, and create seamless experiences, ultimately driving customer retention and growth.

Why Do Banks Need Customer Relationship Management (CRM) Systems?

Banks need CRM systems to enhance customer interactions, streamline operations, and drive growth. Customer relationship management for banks centralizes customer data, providing actionable insights to deliver personalized services. Banks can anticipate customer needs, manage inquiries efficiently, and improve client satisfaction. Banking management solutions enable automation of processes like onboarding, loan approvals, and marketing campaigns, reducing manual effort and improving response times. Additionally, these tools enhance banking customer experience management by offering a 360-degree view of customers, enabling seamless support across all channels. In a competitive market, software solutions empower banks to build trust, boost loyalty, and increase retention rates, ultimately driving long-term profitability. Whether improving customer engagement or streamlining operations, a robust CRM is essential for modern banks to thrive.

What Features Does CRM Software Offer for Banks?

CRM software for banks provides tailored tools to streamline customer relationship management, boost efficiency, and improve client satisfaction. Key features include customer data management, allowing banks to centralize and access detailed profiles, transaction histories, and communication records. Advanced analytics enable personalized financial recommendations and marketing campaigns, enhancing client engagement. Additionally, banking software solutions integrate seamlessly with core banking systems, automating processes such as loan approvals, account updates, and service requests. In the software banking sector, workflow automation ensures smoother operations, while reporting tools provide real-time insights into performance metrics. For the CRM software for financial services industry, security features like data encryption and compliance management help meet strict regulatory standards, ensuring data privacy. These tools empower banks to deliver exceptional service while building stronger, long-term client relationships.

How can CRM improve the efficiency of the banking industry?

CRM for banking industry provides tailored features to manage customer interactions, streamline operations, and drive growth. Key features of a system in banking include centralized customer profiles, automated workflows, and detailed analytics to optimize services. With tools for customer segmentation and personalized communication, banks can enhance engagement and loyalty in the customer relationship management banking sector. Additionally, financial services solutions integrate seamlessly with core banking systems, enabling real-time insights into customer behavior, transaction history, and financial goals. This empowers banks to offer targeted financial products and deliver superior customer experiences. By leveraging automation, advanced reporting, and data management tools, CRM software allows banks to improve operational efficiency, strengthen relationships, and boost profitability, ensuring a competitive edge in the financial services market.

What Are the Benefits of a CRM System for the Banking Sector?

A CRM system for banking provides numerous benefits by streamlining customer management processes. It helps banks build stronger relationships with clients through personalized communication and targeted services. With a financial services software, banks can analyze customer data, track interactions, and identify cross-selling opportunities, leading to increased revenue and improved customer satisfaction.

The management solutions in banking sector enhances efficiency by automating routine tasks, improving collaboration among teams, and ensuring seamless communication across channels. It enables banks to deliver tailored solutions that align with individual customer needs, fostering long-term loyalty. By choosing the best softwaare for financial services, banks gain a competitive edge with real-time insights, enhanced data management, and advanced reporting capabilities. This results in better decision-making, improved customer retention, and a more agile approach to meeting evolving market demands.

What Are the Specific Applications of CRM Solutions in the Banking Industry?

Management solutions play a crucial role in enhancing banking operations and customer relationships. For instance, Microsoft CRM for banking helps streamline client management and optimize workflows, improving operational efficiency across branches. With banking customer analytics, banks can gain insights into customer behavior, preferences, and lifetime value, enabling tailored product offerings and better engagement. Additionally, banking analytics solutions empower banks to predict trends, mitigate risks, and enhance decision-making processes. In commercial banking systems enables relationship managers to track large accounts, manage loan processes, and offer personalized services to corporate clients. Overall, these solutions help banks strengthen relationships, improve customer retention, and drive revenue growth by delivering a seamless, data-driven experience for both retail and corporate banking customers.

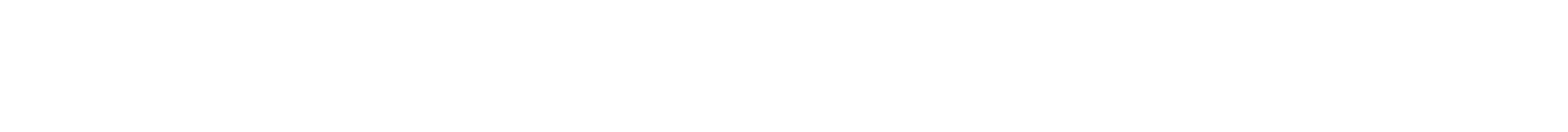

What Are the Key Features of Implementing CRM Software in Investment Banking?

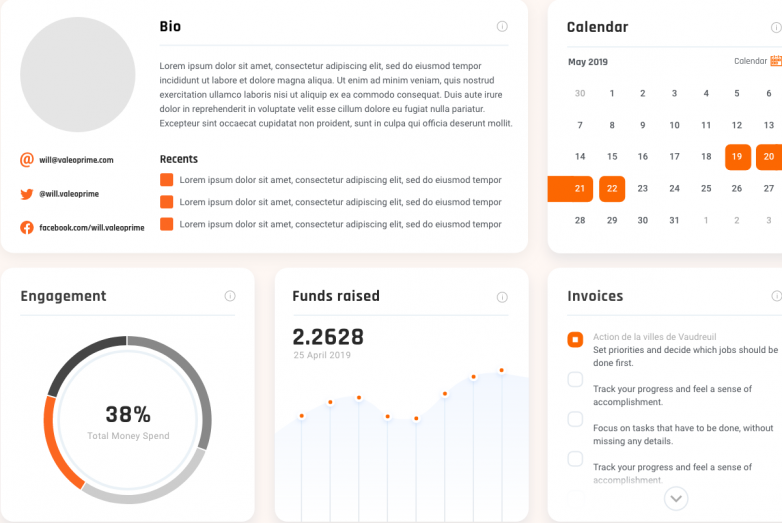

Implementing CRM software for investment banking streamlines relationship management and enhances deal execution. Solutions for investment banking allows firms to centralize client data, track interactions, and manage pipelines effectively. Features include advanced reporting tools, opportunity tracking, and seamless integration with communication platforms. The investment banking software enables personalized outreach, helping bankers nurture relationships with clients and stakeholders. It also improves team collaboration by offering real-time updates on deal progress. Security is a critical component, ensuring sensitive financial data remains protected. To maximize efficiency, the best CRM for investment bankers should provide robust analytics, automation tools, and customizable dashboards tailored to investment banking workflows. By optimizing processes, it empowers bankers to focus on client acquisition and deal closure, driving revenue growth while maintaining compliance.

What Are Some Examples of the Best CRM Systems for the Financial Industry?

When exploring CRM software examples for the financial industry, some top platforms include Salesforce Financial Services Cloud, Microsoft Dynamics 365, and Creatio. These tools are tailored to enhance client relationships, streamline operations, and improve financial insights. A common example of CRM in banking is using systems to manage customer profiles, automate loan processes, and offer personalized financial products. These systems support better communication between banks and their clients. The types of solutions in banking can include operational, analytical, and collaborative systems. Operational CRMs automate daily tasks, analytical process customer data for insights, and collaborative platforms improve team communication. A notable system banking example is integrating CRM with core banking systems to offer targeted products based on client history, increasing customer satisfaction and loyalty.

CRM Software in Banking Industry

It is recognized as a computing system that financial institutions use to track and assess clients' monetary activities to provide enhanced services. The system merges customer information gathered from various channels, such as online transactions, in-branch visits, emails, and responses to telephone inquiries, into a single unified system.

Key Functions of Banking CRM Systems:

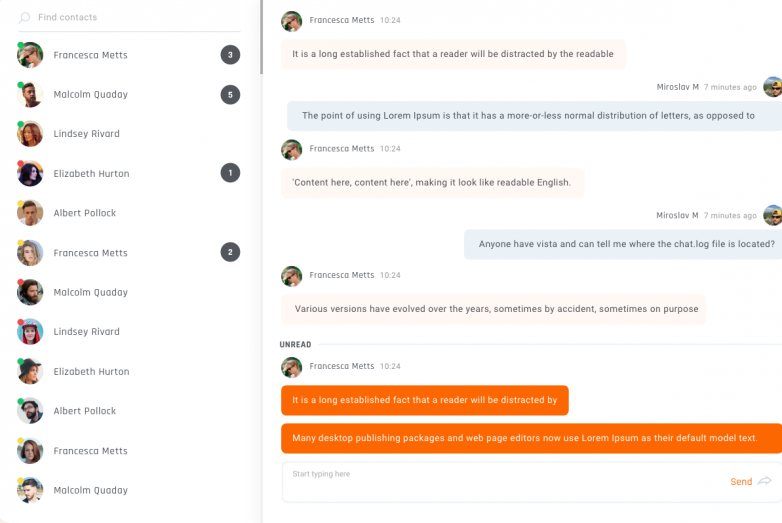

- Customer Data Management – A management system for banking brings together all information related to customers, including personal data, transaction history, and communication logs.

- Sales and Lead Tracking – This enables the organization to keep an eye on potential prospects, monitor conversion rates, and efficiently oversee sales processes.

- Customized Customer Engagement – Financial institutions can provide specific services based on the distinct financial needs and preferences of each client.

- Banking Process Automation – CRM streamlines tasks such as approving loans, verifying documents, and following up with customers.

- Management of Regulatory Compliance – It ensures adherence to financial regulations by securely storing and handling customer data.

Transforming the Customer Experience with CRM

The CRM in finance transforms customer encounters by creating efficient customized processes. Through predictive customer need forecasting to provide modified solutions that lead to enhanced client happiness and loyalty levels.

Improving Bank Lending Practices through CRM

- Customer relationship management for banks systems by improving operational efficiency and enhancing customer creditworthiness evaluation. Key enhancements entail:

- Multiple data sources within the systems generate complete customer profiles that enable exact credit risk assessments by understanding clients' financial details.

- Customer-specific outreach becomes achievable because the data helps them create personalized approaches that meet individual requirements thus building stronger relationships with borrowers.

- The regulatory requirements are best served by CRM systems because they maintain detailed documentation of customer interactions and transactions which ensures readiness for audits.

- The organization can detect new customer product sales chances through data analysis to boost its revenue potential.

- Customer retention strategies develop from management systems that monitor feedback to help build effective retention strategies and lower customer attrition rates.

- CRM tools help to protect against risks by providing real-time data analysis which enables the company to make correct lending decisions.

- The dashboards enable the company to evaluate their employees' performance while assessing their lending processes thus pushing for continuous advancement.

- The company can achieve operational uniformity by allowing its platforms to establish connections with core banking and payment processing systems through integrated system frameworks.

- CRM systems provide outstanding customer experience through personalization and operational efficiency of lending operations that lead to stronger customer relationships.

Why CRM is Essential for the Banking Industry?

- Having a detailed database of customer information enables the organization to predict their client's needs and provide immediate assistance and customized financial products.

- Satisfied customers tend to keep using their bank as their primary banking relationship.

- The system allows the organization to determine customer departure risk and creates retention strategies.

- The CRM capabilities enable the staff to drive revenue expansion by identifying appropriate opportunities for both cross-selling and upselling additional products.

- The company recommends relevant banking products through the analysis of customer conduct and financial records including the following options:

- The financial institution provides house purchase mortgage loans to its customers.

- Wealth management professionals offer their services to customers with high net worth.

- The banking system provides better credit cards depending on how customers use their existing ones.

- Financial operations become more efficient when the processes are automated which results in decreased manual labor and less documentation while increasing business productivity.

- The finance companies operate under mandatory regulatory standards that include GDPR together with CCPA and financial security regulations for compliance purposes.

Implementing CRM in Banks: Best Practices

- The institution should accomplish these best practices when intending to maximize its system's benefits:

- The implementation needs specific goals set as retention targets and opportunities to sell additional services to existing clients.

- An organization should choose a platform that matches its operational requirements and offers smooth integration with current programs.

- A proper data quality management system should maintain precise up-to-date customer information which enables optimal analytics results.

- The organization should develop detailed training sessions for personnel which enable them to use the system effectively.

- The company should create strategies that put product demands and individual preferences from customers at the forefront to build satisfaction throughout their entire relationship.

- The organization should evaluate the performance regularly while applying enhancements that result from customer feedback and changes in business needs.

- The organization needs to create a change management protocol that handles resistance challenges and facilitates easy adoption of the new CRM solution.

- The system needs to combine strong security features that guard customer information while following regulatory rules.

- The system must have capabilities to integrate with banking applications that generate unified customer data views.

CRM for Banking Industry: Optimizing Loan and Lending Processes

Automated tasks and enhanced efficiency form the primary strengths of management systems when it comes to loan approval processing. These tools boost the lending process through the following system functions:

- Automated Credit Score Analysis

Businesses utilize CRM solutions that evaluate borrowers' credit quality through analysis of their previous financial records. Multiple data sources linked to the systems allow them to obtain credit score information as well as financial histories from credit bureaus without requiring manual evaluation. A quick assessment of customer eligibility for loans becomes achievable because of this technology which reduces errors and accelerates loan approval decisions.

Automated credit score analysis conducts precise loan applicant evaluations which simultaneously saves both organizational time and operations expenses.

- Faster Loan Approvals

The loan application procedure demands administrative staff to validate personal data along with documentation and verify applicant's qualification status. The implementation of predefined workflows in the systems automates several critical operations that enhance manual check processing and approval speed.

The system verifies all documents at high speed to complete approvals in a shorter time period which improves customer satisfaction.

- Personalized Loan Offers

A CRM platforms combines customer data analysis with information on customer finances and behavior patterns together with long-term monetary objectives. Through gathered data, the system creates specialized loan choices to fulfill individual customer requirements. A customized solution enhances customer satisfaction and loan approval odds because banks can present financing products that match borrowers’ individual profiles.

Personalized loan recommendations through technology benefit companies by offering plans that match individual customers with their budget needs and aspirations thus producing more knowledgeable and content clients

- Real-Time Loan Tracking

Customers typically need to check the progress of their loan applications after they apply. The system delivers instantaneous tracking capabilities that enable employees at the bank and their applicants to monitor application statuses throughout time. The system allows staff members to make quick updates which generate instant alerts to customers that minimize their anxiety and build trust.

The real-time tracking system works toward strong communication and transparency which gives customers updated information and maintains their control over loan status monitoring.

- Fraud Detection and Risk Management

The automated systems provide alerts for unpredictable loan application anomalies which help the bank stop funding risky deals during the pre-approval procedure. CRM solutions perform risk assessments through their analysis of credit risk and provide predictions about applicants.

By detecting fraudulent activities the banking software solutions become able to manage risks which ultimately reduces the number of high-risk loan approvals thus preventing financial losses.

- Improved Customer Relationship Management

The purpose of this system is data management of customer information to establish stronger lasting connections with borrowers.

Better individualized service delivery produces devoted customers who will conduct business repeatedly.

- Data Analytics and Reporting

These systems operationally merge information from different customer interactions to reveal patterns and understandability through data analysis. The gathered information about customer activities together with market trends enables banks to modify their lending solutions alongside their specific marketing approaches.

Challenges in CRM Implementation

- The implementation of the systems leads banks to encounter various obstacles which include:

- Malefactors exist when customer information resides between multiple database systems since it proves challenging to unify those databases into a single platform. The successful implementation requires banks to manage proper data integration as well as migration between systems.

- Resistance among employees occurs when staff members do not want to use new technology because of their unfamiliarity with it and their concerns about extra work. The adoption of CRM by banks requires both proper staff training and thorough information distribution regarding system advantages to eliminate employee hesitance.

- The deployment of customer relationship management systems implies substantial expenses related to software applications and personnel training together with equipment infrastructure.

- The long-term advantages of a new system normally exceed the expenses incurred at the beginning.

Future Trends and Innovations In CRM Software for Banking Industry

Financial institutions face ongoing sector modifications which require solutions to develop new capabilities. Some emerging trends include:

- Customers now need to experience the interactions without interruptions during their contact through mobile apps and website platforms as well as physical banking locations. When the systems integrate properly they deliver constant messaging throughout every communication platform.

- Through blockchain technology, the company deliver enhanced transaction security together with transparency which results in better system reliability.

- The systems enable the integration of voice assistants together with chatbots to deliver improved customer support services which also minimize response times.

- These platforms use predictive analytics to evaluate potential risks through which they deliver data-based lending decisions.

- Cloud-based CRM Solutions represent the choice of more financial companies to obtain scalability with flexibility and lower costs through their use of cloud technology systems.

CRM Implementation Case Studies in Banking

- Wells Fargo: Enhancing Customer Experience

Wells Fargo established a CRM system that merged customer data to deliver better-individualized banking encounters.

- HSBC: Optimizing Multi-Channel Banking

HSBC unified its CRM system to function between online and offline banking platforms for continuous customer contact. The strategy let HSBC increase staff productivity while optimizing loan processing and providing better customer assistance across operations.

- Citibank: AI-Powered Fraud Detection

The CRM solution from Citibank contained sophisticated algorithms which helped prevent financial risks. By analyzing customer transaction data the system detected unusual activities before preventing such actions.

- Bank of America: Automated Customer Support

AI-backed chatbots integrated into CRM systems at Bank of America enabled the handling of customer queries in an efficient manner. The automation system cut down waiting times while delivering superior satisfaction to customers.

- Deutsche Bank: Data-Driven Decision Making

Deutsche Bank integrated a CRM system that delivered immediate visibility into client behavioral patterns and market financial movements thus allowing superior investment and lending service choices.

Conclusion

Financial institutes use CRM technology to transform customer contact while simultaneously boosting operational productivity and business money-making abilities. Advanced solutions enable the institution to gain important industry advantages through flawless customer experiences and improved sales methods as well as workflow optimization capabilities.

The advancement of the banking industry depends heavily on the system which will grow in importance for industry success. Financial organizations that successfully implement the solutions through digital transformation initiatives will gain better competitive advantages in serving their customers while complying with rules and securing permanent market development.