Top-notch CRM Solutions

for Insurance Agencies

Solutions Metrix has all the CRM tools you need to sell more, service better, and rise faster your business.

We help insurance agencies provide next-level customer experience and run a smoother operation

by automating tasks, tracking leads, forecasting sales.

Our Clients

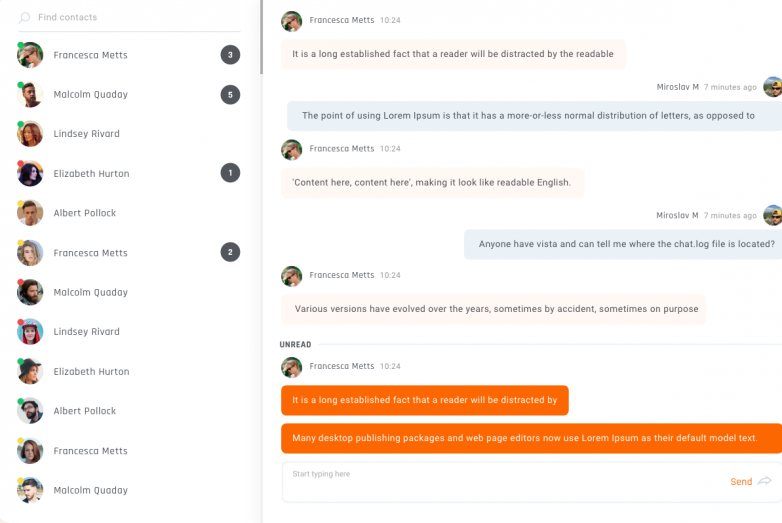

Engage with your clients using their preferred channels of communication. You can set your channels based on client demographics. Create and execute marketing strategies based on client segments and different communication channels to achieve maximum ROI for your efforts. Stay on top of industry rules and regulations by making sure you are compliant to avoid corporate legal issues by adhering to PIPEDA data privacy and CASL electronic threats regulations.

Shorten Claims Resolution Processes

By identifying your clients quickly and accurately, you can initiate the claims process with fewer delays. Furthermore, a guided and standardized claims process ensures that all the protocols are adhered to. No more guesswork involved in the process!

Provide Self-Service Options and Build Long-Term Relationships

Whether on mobile or browser, personal portal capabilities allow your clients to be independent in managing their policies, submitting claims, changing payment methods, etc. and reduces the customer service team’s workload who no longer needs to look after such matters. Besides, the ability to completely and accurately identify a client allows you to create and sell customized policies for them, thereby building a long-term relationship and increasing the overall lifetime client value (CLTV).

Faster Employee and Client Onboarding

The average onboarding time for the internal sales team can be reduced by up to 75% with a successful CRM implementation. A standardized sales cycle, client onboarding, client nurturing, and account management with CRM keeps your team focused on selling more rather than figuring out what tasks to perform. Whether you are a broker or an insurance company, your clients’ centralized management and offerings enable you to manage your group clients more efficiently in a more streamlined manner.

Improve Customer Interaction

Empower your client services team by providing them with all the client information at their fingertips. Maintain the quality of their communications by customizing agent scripts. Reduce call hold times and provide faster responses to your clients, thereby enhancing your insurance company’s client experience. All types of processes like onboarding, upsell, claims, or policy changes can be easily managed while maintaining communication and standardization.

Clients’ Warm Words about Our CRM Consulting Services

“Thanks very much for your great support on this project. It was a pleasure working with you.”

"Thanks Olivier! A big thanks on turning around solutions so quickly in the last couple of weeks for the slight issues we discovered. The team went live with the safety abroad system on Wednesday and I couldn’t be happier!"

Looking to Upgrade Your Current CRM

or

Make the Switch to a Better System?

CRM for Insurance Frequently Asked Questions

FAQs

What Is the Best CRM Software for Insurance?

The best insurance CRM software depends on your company’s unique needs, such as managing client relationships, automating tasks, and improving policy tracking. A CRM for insurance companies is designed to streamline operations, enabling agents to track leads, manage renewals, and provide personalized service. Solutions offering tailored CRM insurance services often include features like workflow automation, claims management, and customer segmentation. When evaluating options, look for CRM software for insurance that integrates seamlessly with your existing systems, supports data-driven decisions, and enhances client satisfaction. Popular choices like Salesforce, Zoho CRM, and Creatio provide industry-specific tools, ensuring improved productivity and client retention. The right CRM empowers insurance professionals to manage their relationships effectively, deliver exceptional service, and boost growth.

Why Do Insurance Agents Need Customer Relationship Management (CRM) Software?

Insurance agents require CRM software to efficiently manage client relationships and drive business growth. CRM for insurance helps agents organize leads, track policies, and improve client communication from a single platform. By automating tasks like follow-ups and renewals, agents save time and reduce errors. The best insurance agency software offers advanced tools to manage client data, analyze trends, and deliver personalized service, ensuring higher customer satisfaction and retention rates. For agents looking to scale their business, CRM software for insurance agents streamlines operations by integrating features like sales tracking, reporting, and claims management. Additionally, insurance agency management systems centralize all workflows, making it easier to handle policies, documents, and customer interactions. In short, a robust CRM empowers insurance agents to focus on clients, boost productivity, and enhance overall business performance.

What Features Should a CRM for Insurance Brokers Include?

The best CRM for insurance brokers should streamline operations and enhance client relationships. Key features include automated lead management to capture and nurture prospects efficiently, and robust policy tracking for renewals and claims management. Integration with communication tools like email and SMS ensures timely follow-ups, while advanced reporting and analytics provide insights into sales performance and client trends. CRM software for insurance brokers should also offer customizable dashboards for quick access to essential information. For larger teams, collaboration tools and task automation are critical for improving workflow efficiency. Additionally, CRM for insurance agencies should ensure data security and compliance with insurance regulations. Modern insurance CRM systems may include AI-powered features like predictive analytics to help brokers identify cross-selling opportunities and boost revenue.

How Does a CRM for Health Insurance Work?

A CRM for health insurance streamlines customer management by organizing policyholder data, automating follow-ups, and enhancing client relationships. It centralizes information such as coverage details, renewals, and claims, allowing agents to efficiently manage their workload. The best CRM for health insurance agents simplifies lead tracking, policy management, and communication, ensuring agents stay organized and responsive. For insurance agencies handling multiple policies, insurance agency software automates repetitive tasks like reminders, reporting, and policy updates. This saves time and reduces errors. Additionally, a CRM for life insurance agents helps monitor client milestones, ensuring timely policy reviews and personalized offers. By integrating these tools, insurance professionals can provide better service, increase client satisfaction, and drive growth for their agencies. A tailored CRM is essential to managing the complexities of the insurance business efficiently.

How Does a CRM Improve Productivity for Life Insurance Agents?

A CRM life insurance solution streamlines processes, helping agents manage client relationships efficiently. The best CRM for life insurance agents automates repetitive tasks like policy follow-ups, appointment scheduling, and lead tracking. With centralized access to client data, agents can personalize communication, improving client satisfaction and retention. Insurance agency management software integrates workflows, reducing manual data entry and minimizing errors. This allows agents to focus on selling policies and nurturing leads instead of administrative tasks. The best CRM software for insurance agents also offers advanced analytics, helping agents identify sales opportunities, prioritize leads, and track performance metrics effectively. Overall, a CRM enhances productivity by automating workflows, organizing client data, and providing actionable insights—allowing life insurance agents to close deals faster and grow their business.

How Does Dynamics 365 CRM Enhance Customer Experience in the Insurance Sector?

Dynamics 365 CRM for insurance transforms how insurers engage with clients by delivering personalized, seamless experiences. As a CRM for insurance industry professionals, it centralizes customer data, enabling agents to anticipate client needs and provide timely support. For health insurers, a CRM for health insurance agents simplifies policy management, claim processing, and follow-ups, improving customer satisfaction. Additionally, Dynamics 365 CRM for insurance companies automates workflows and integrates communication channels, ensuring a faster response to inquiries and claims. Agents gain a 360-degree view of customers, allowing them to offer tailored policies and proactive service. This enhances trust, loyalty, and retention—key factors for success in the insurance sector. By leveraging actionable insights and real-time data, insurers can deliver superior experiences while streamlining operations.

CRM Software for Insurance Companies

Insurance competition remains high while client connections govern the industry toward efficient tracking of customer files and contacts. CRM (Customer Relationship Management) systems serve as major tools that insurance companies and agencies require in this active sector. The platforms serve as a centralized system that allows businesses to optimize their processes while improving customer service delivery and maximizing sales efficiency through policy management claims handling and communication coordination.

A CRM for insurance represents more than basic storage because it provides transformational benefits that allow organizations to develop solid client relationships combined with interaction tracking and business expansion insights. Insurance agencies that implement CRM software achieve automation of manual work as well as personalized service delivery and enhanced lead management which drives better customer loyalty and satisfaction.

CRM software transforms the way businesses connect with their clients through a combination of life insurance services with health and property insurance sectors. The system gives agents together with sales teams the tools that allow them to process inquiries swiftly and nurture leads quickly while closing deals efficiently. Organizations that wish to flourish in the current marketplace must make the right CRM system decision because it drives competitive engagement and operational efficiency while securing long-term business achievement.

What is a CRM for Insurance?

Businesses need a Customer Relationship Management (CRM) system as their powerful operational tool to improve customer contact management and operational streamlining and maximize operational efficiency. Insurance industry stakeholders depend on CRM systems as a core platform that gathers client data and follows policy information coupled with automatic communication features.

The CRM for insurance specifically follows the solutions that it needs to exist within the insurance business model. The system enables insurers to smoothly control their customer database while guaranteeing full accessibility of all client interactions. An organized system enables insurance agents to provide customized service to clients thus establishing trust and loyalty in the competitive insurance sector.

Experimental tasks at insurance agencies become more efficient through CRM software for insurance which both schedules automatic policy renewal notifications and claim status updates. The system provides important intelligence through data analytics tools that let businesses identify market trends and predict future needs as well as improve their sales methods.

CRM for insurance industry creates basic operational advantages that result in fundamental customer-business interaction modifications. A CRM system helps insurance businesses establish better relationships with their clients.

Benefits of Using CRM Software for Insurance Companies

Improved Customer Retention and Experience

Insurance sector prosperity depends on establishing robust relationships with customers since these connections secure lasting business outcomes. These systems help insurance companies retain customers through individualized communication approaches that yield superior service quality. The CRM for insurance companies enables insurance agents to track complete records about customer preferences while recording policy details alongside former interactions thus supporting individualized recommendations.

The CRM software for insurance companies operates automatic policy renewal systems that prevent clients from missing important dates. CRM allows organizations to send customized greetings during birthdays or holidays thus creating stronger emotional ties between clients. The delivery of relevant immediate communication helps insurers establish trust bonds with customers while making them more satisfied and loyal thus securing their competitive advantage.

Enhanced Sales and Lead Management

Effective lead management through CRM systems functions as a fundamental requirement to boost insurance industry sales. Insurance agents use lead tracking and analysis to decide which valuable prospects will receive their focus for becoming loyal policyholders.

Insurance agents who implement CRM for insurance sales operations can track their sales pipeline activities starting with lead acquisition and completing with deal closures. The combination of automated follow-ups with lead scoring tools makes sure insurance agents do not fail to capture any potential opportunities. Insurance agencies utilizes the best CRM for insurance agency solutions to gain access to marketing integration enabling agents to execute targeted campaigns and successfully nurture their prospects. The sophisticated system enables sales conversion at an accelerated rate which generates greater revenue.

Streamlined Processes and Data Analytics

Insurance organizations handle extensive volumes of information which CRM in the insurance sector successfully manages through their vital operational role. CRM software makes businesses operate more efficiently by both automating normal procedures and generating data-based knowledge.

CRM for life insurance companies utilizes automation to maintain client profile information and to track claims as well as policy documentation. The insurance sector uses CRM systems with advanced analytical tools that help businesses recognize customer patterns for anticipating client needs and improving their operational plans. Insurers gain a boost in productivity by using automated processes along with actionable insight which decreases human errors and creates wise choices that propel business expansion.

Tailored Solutions for Different Insurance Types

CRM systems deliver customization capability to adjust for the different needs of insurance businesses. Insurance businesses can establish CRM systems that adapt to distinct requirement needs between life coverage, health insurance, and property protection services.

With CRM for life insurance agents can efficiently handle enduring policies combined with beneficiary tracking to provide service excellence to their clients. CRM system for health insurance maintains accurate handling of claims processing and policy renewal procedures and all client correspondence. Specialized CRM solutions guide insurance firms to offer unique services while handling industry requirements which results in extraordinary value for their clients.

Specialized features found in CRM systems support property insurance businesses in running efficient operations for handling policy records and claims while also processing property evaluations smoothly. Inspection dates claim statuses and renewal deadlines become easily manageable through these CRMs which keep agents organized in their work. CRM solutions from property insurance agencies strengthen customer relationships by giving clients individualized treatment and automated service alerts about policy changes and home inspections. CRM systems address specific insurance sector requirements to produce operational enhancements that enable businesses to customize their services across multiple insurance lines.

Key Features of the Best CRM for Insurance Agencies

Insurance agencies should select CRM solutions that incorporate features to streamline operations and boost efficiency while delivering better satisfaction to their customers. Insurance-specific systems exist to satisfy the professional requirements of insurance agents so they can build better client relationships and achieve sales objectives.

A superior CRM system provides insurance agencies with a simple solution to track policy management through renewals, cancellations, and modifications. The system allows agents to view all policy information from one central location thus ensuring they maintain readiness when attending to client needs. A CRM system delivers quick service and preserves customer faith through its essential tracking functionality. A top-quality insurance CRM system streamlines policy controls to minimize human errors while maximizing agency efficiency.

- Claims Management

The efficient management of all claims stands as a vital factor for achieving high customer satisfaction. Best insurance CRM solution for insurance agencies must include integrated claim management capabilities which enable agents to track claim progress while delivering updates and solving problems speedily. The system's open approach motivates clients to feel confident about their interactions and receive better service throughout their claims process. - Document Handling and Storage

Insurance agencies manage substantial documentation ranges that include both policy documents and claims forms. The strong CRM system for insurance agencies provides secure document storage together with quick retrieval features so agencies do not need to manage files by hand. The secure document storage available within the system creates operational efficiency that simultaneously maintains industry regulations. - Ease of Use and Customization

Insurance agencies manage substantial documentation ranges that include both policy documents and claims forms. The best CRM for insurance agencies provides secure document storage together with quick retrieval features so agencies do not need to manage files by hand. The secure document storage available within the system creates operational efficiency that simultaneously maintains industry regulations. - Integration with Other Tools

Contemporary CRM systems establish effortless connectivity to multiple software platforms including marketing solutions along with customer service tools. The connectivity between different tools allows insurance agencies to sustain smooth communication across all platforms and operate more efficiently. Agencies searching for growth should invest in the best CRM for insurance agencies because it enables scaling potential thus becoming a valuable long-term investment.

Insurance agencies achieve organizational excellence along with successful service delivery through these features which give them a competitive advantage in their market sector.

How to Choose the Right CRM Software for Insurance Companies

The choice of CRM software specific to the insurance sector creates substantial effects on business operational performance and customer contentment alongside widespread company achievement. Multiple CRM software for insurance companies choices exist so agencies must evaluate multiple important factors to match their systems with organizational requirements and objectives.

- Understand Your Business Size and Requirements

Your required CRM system features depend on your company's current size. The needs of smaller agencies mainly focus on usability combined with affordable solutions but larger enterprises need advanced automation features along with integration capabilities. Business expansion should be considered during CRM software selection because effective insurance company software solutions should scale according to business growth needs.

- Consider the Type of Insurance You Offer

The distinct features of insurance products require various business requirements during implementation. Your choice of CRM system needs to include comprehensive policy tracking and extended client relationship capabilities if your business deals with life insurance. Health insurance users should emphasize features that manage claims while providing superior support mechanisms. The best CRM for insurance solutions for insurance operates best when it provides flexible options to meet particular requirements within your industrial field.

- Evaluate Scalability and Flexibility

Your CRM system needs to adjust its capacity to manage expanding data volume as well as additional customers and workflows during business growth. A CRM must show scalability features to adapt to your ongoing needs because scalability determines how well the system fulfills your requirements over time. While you must have a system which tailors its functions to meet your specific business requirements.

- Prioritize Integration and Support

The ideal CRM software integrates without delay with your existing platforms such as marketing platforms, analytics tools, and email systems. The combined system enables consistent operational procedures across the board. Excellent customer support serves as a necessity for CRM troubleshooting and the optimization of its potential. A CRM system that stands as the best for insurance providers must feature both continued service maintenance along platform upgrades to sustain operational excellence.

Case Studies or Examples of CRM in the Insurance Industry

The adoption of CRM in insurance company resulted in enhanced operational efficiency superior customer experiences and monetary expansion. Two distinct examples reveal how CRM software brought operational changes to insurance companies and agencies.

1. Enhancing Customer Retention for an Insurance Company

The health insurance company experienced declining customer retention because of their slow response times together with disorganized policy administration. A CRM implementation within the insurance company provided employees with one-stop access to complete client information. Through their CRM implementation, the insurance company achieved renewed policy coverage from 25% more customers during the first six months.

The company utilized analytic tools to gain customer behavior insights which became instrumental for developing services that accommodated individual client needs. By making customer service more satisfactory the company achieved increased cross-selling capabilities which led to substantial revenue growth.

2. Streamlining Operations for an Insurance Agency

The rising client volume at their insurance agency became difficult to handle their growing number of inquiries combined with claims processing. The insurance agency selected a CRM platform to automate their operations including claim tracking and document handling together with follow-up tasks. The streamlined processes reduced both manual mistakes and response times which enabled claim resolutions to be completed 40% faster.

The CRM system enabled agents to boost lead management by applying lead scoring and follow-up alert systems to transform prospects into sustained clients. The agency reached peak communication capabilities between departments while their employees started collaborating better through complete system integration.

The mentioned scenarios demonstrate how CRM technologies drive fundamental operational changes in insurance businesses and agencies. Insurance companies that implement CRM systems in their operational workflows combined with agency tasks will generate better operational efficiency and improved customer experiences while attaining sustainable company development.

- Improving Sales and Lead Generation for an Insurance Brokerage

The independent insurance brokerage struggled to handle incoming leads and transform those prospects into client customers. The company decided to implement CRM for insurance agencies to optimize lead generation as well as sales monitoring operations. The CRM system of the brokerage used automated features to collect leads from multiple channels as well as match prospects with suitable agents based on determined criteria.

Through the CRM system agents received complete lead information featuring client interests and recorded preferences alongside previous interactions for tailoring their reach. The company implemented automatic reminder systems together with pipeline management tracking which made sure every lead received proper attention leading to improved conversion performance. The brokerage earned a 30% expansion in new customer acquisition alongside a 20% rise in business income during the one year with no compromise to their high standards of service quality.

The analyzed case proves that CRM platforms deliver dual benefits to insurance organizations by advancing lead management while advancing sales productivity which generates elevated revenue streams and client enrollment results.

Conclusion

Insurance agencies along with companies must use CRM systems to stay competitive in the ever-changing market today. Insurance companies benefit by aggregating customer information through CRM to automate normal business processes which generates actionable analysis that enables them to personalize customer interactions as well as improve operational efficiency and sales performance. A proper CRM solution enables insurance businesses to improve their operations by handling claims and policies alongside lead development and customer loyalty practices.

Insurance agencies depend on CRM for insurance platforms to deal with sophisticated workflows as well as maintain reliable high-quality customer service. The system enables agents to simplify their tasks which includes document processing alongside follow-up operations with lead management to build stronger client relationships. Advanced analytics tools enable companies to base their decisions on data and automation systems let them quickly respond to changing industry patterns.

Every insurance company that aims for growth needs to select the correct CRM for insurance agencies system to advance their operations. Check out today's market offerings of CRMs for insurance agencies and companies to discover platforms that meet your business requirements. The appropriate system implementation will enhance your business operations and foster better customer satisfaction leading to long-term organizational success.